Retail Futures – The Technology Imperative

“The aspects of our business model that hitherto made us successful were crystallized into our operation to sustain and ensure that success. However, as we try to adopt new business models and practices, those hardened beliefs and processes are the very things that will hold us back”

Great quote, but it’s not one that can be attributed to anyone yet. When it can, it represents an understanding that a new breed of technology-centric organizations is already revolutionizing the retail industry and today’s traditional retailers need to reinvent themselves or perish.

What is Retail

The provocation is that a traditional retailer’s current set of capabilities and differentiators no longer delivers competitive advantage: Drop Ship Vendors, Third Party Logistics and Last Mile Delivery, Electronically Fulfilled Products, International Fulfillment Agencies, Payment Transaction Handlers, Auction Sellers, Marketplaces and Full-Service Ecommerce Cloud Services have removed the barrier to entry. A host of new entrants, not instantly recognizable as retailers, is turning the retail experience inside out.

Tomorrow’s retailer has developed a native multi-channel model, has the channels to help people buy products from anywhere at any time and is able to leverage a variety of purchase, finance and fulfillment models. Not only that, they will display the systems agility to make continual improvements, rapid maneuvers, course changes and radical overhauls to respond to new threats, market trends and consumer behaviors.

This post dissects the broader retail experience as it is shaping up and sets the technology imperatives for the modern retail enterprise.

The Evolution of Retail

From markets and bazaars to stores and malls, the pre-internet retail environment matured over thousands of years. Mom and pop stores evolved into mass-market chains that allowed them to increase their volumes, to develop a power over suppliers, to conceptualize the supply chain and drive competitive advantage through technology.

In this model, the retailer performed the tasks of product selection, inventory management, breaking bulk and distribution through warehouses, trucks and stores. The consumer selected from the products on the shelves, paid the price that was asked and transported the products home. That spelt customer satisfaction.

Yet in the space of fifteen years, consumers have grown comfortable with stores on the web, product search engines, online payments, fulfillment to the home with tracking, consumer service available 24-7 and being able to rate products and vendors in public. This is only the beginning.

Accelerating Pace of Change

After years as innovators, it is now not traditional retailers driving the change in consumer behavior – the bulk of innovations are coming from technology start-ups. The listing below provides examples of such innovations that are resetting expectations as to how products are found, evaluated and purchased.

| Company | Innovations Developed & Inspired | Founded |

|---|---|---|

| Amazon | Reviews & ratings, Shipping options, One-click ordering, Recommendations, GoldBox limited time offers, Fulfillment web services | 1994 |

| Ebay | Online auctions, (leading to Consignment Sales), Seller ratings, Marketplace research services for vendors | 1995 |

| Craigslist | Free classified online advertising, Temporary phone numbers, inspired housing maps mash-up | 1995 |

| Netflix | Online movie rentals with no late-fees, Electronic fulfillment | 1997 |

| IMDB | Detailed reference site for all movie information, indexed cast, production team, genres etc. (acquired by Amazon) | 1998 |

| Zappos | Free shipping and returns (acquired by Amazon) | 1999 |

| NextTag | Comparison Shopping as a link exchange | 1999 |

| Half | Person-to-person online marketplace (acquired by eBay) | 2000 |

| TripAdvisor | Peer reviews coupled to online booking/td> | 2000 |

| Pandora | Peer recommendation driven content stream with direct links to ecommerce sites | 2000 |

| Walmart.com | Order online, pick up in store, order from store inventory | 2000 |

| Gamefly | Mail-fulfilled game library, Rent rather than buy. | 2002 |

| Paypal | Cashfree ePayments | 2002 |

| User created content, peer networks, accredited recommendations | 2003 | |

| Orbitz | Price matching, Multi-variable selection | 2004 |

| Oodle | Classified ad’ aggregator | 2004 |

| Kayak | Latent search requests, exemplary faceted search | 2004 |

| VUDU | Electronic Fulfillment | 2004 |

| P2P Recommendations, Marketplace, Messaging, Fanpages | 2004 | |

| Woot | One-time one-day offers | 2004 |

| Like | Visual search | 2004 |

| Etsy | Online craft-faire marketplace | 2005 |

| BazaarVoice | Consumer product reviews and recommendations | 2005 |

| Swoopo | Bidding Fee Auctions | 2005 |

| Life-streaming, Social shopping, Link-sharing | 2006 | |

| Superfish | Visual Search | 2006 |

| Zynga | Online gaming, virtual products | 2007 |

| Bling Nation | Electronic currency | 2007 |

| Google Products | Product aggregator across online vendors | 2007 |

| Mint | Cross-vendor personal finance analytics | 2007 |

| Crowdflower | Crowd-sourced labor (augmenting Mechanical Turk) | 2007 |

| Alice | Manufacturer direct marketplace | 2008 |

| Groupon | One day online coupons | 2008 |

| BestBuy Remixed | Open APIs to catalog, stores and inventory | 2008 |

| Foursquare | Check-ins, Personal recommendation and location awareness | 2009 |

| CarrotMob | Group buying contracts with physical stores | 2009 |

| Square | Checkout on a mobile device | 2009 |

| OneKingsLane | Members shopping club | 2009 |

| Lockerz | Social commerce – points for products, earn points through recommendations and referrals | 2009 |

| Boutique | Individually tailored fashion boutiques (acquired by Google) | 2010 |

New Dimensions of Retail

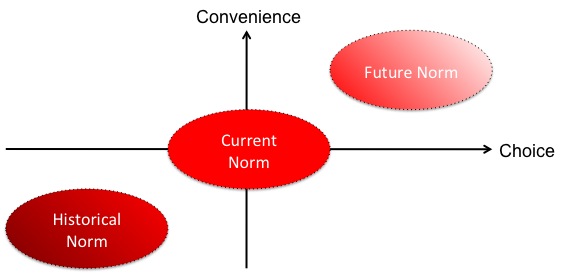

Retail experiences evolved by increasing both convenience and choice:

- Local general stores that were reasonably convenient but with limited assortment (e.g. Woolworths, metropolitan Walgreens stores)

- Big-box retailers provided a dramatic increase in assortment, but with the cost of a long drive (e.g. IKEA, K-Mart and Home Depot)

- These have evolved to an immense range that can be home delivered (e.g. Amazon, Overstock and eBay)

The future should be pointing to an even greater choice and convenience for the consumer.

Beginning with the premise that consumers seek convenience and choice in their shopping experience these can be dissected into smaller more actionable dimensions that align to the shopping process:

| Dimension | Description | Required Updates |

|---|---|---|

| Discovery | Consumer is looking for possible places to select, compare and purchase | Allow not just the site to be discoverable, but also products, inventory and price to be easily discovered from anywhere. Recommendations from friends and social network contacts will provide a powerful means to discovery – requiring the ability to respond to social media activity. |

| Choice | Consumer demands a broad enough assortment that will meet their needs | Systems and business processes that scale equally to importing and enabling large product assortments to be catalogued displayed and sold on the site and in physical stores. Constraints to this are often not the transaction processing systems, but the interfaces with third parties. |

| Search Precision | Allowing consumer to specify their needs and then return an optimal number of relevant results | Improvements to the entire search experience allowing a more precise faceted search experience and more relevant results. |

| Comparison | Allowing consumer to compare product features, prices and deliver and service options whether this be product vs. product or absolute peer reviews | An open way of accessing item details, availability, service level information such that any view of products can be ‘mashed up’ internally or externally. |

| Auction | Competitive bid situations (auction, reverse and Dutch) and competition | A flexible approach to site that would include location, time and competitive prices as a variable that could drive price functions. |

| Promotions and Deals | Time limited price or volume discounts on items, group buying and deal mechanisms | An item master infrastructure that is flexible enough to set up price, time and consumer functions to allow marketers to innovate on pricing and promotional policy. |

| Bundling | Products grouped into logical bundles to provide benefit or saving for the consumer | Flexibility of how orders are created to allow items to be grouped arbitrarily and treated as a single item for pricing, promotional and shipping purposes. |

| Gamification | Elements of game theory that create competition – such as achievement levels, peer comparison and recognition, challenges and virtual currencies | The customer data warehouse must allow for new persistent variables that can potentially be traded between customers and subjected to a set of business rules that can be programmed. Driving variables can be added to provide function inputs to the calculation of scores. A flexible and modular user interface should also be available. |

| Payment | Allowing ease of payment with minimal hurdles or friction but with adequate security | Designing systems that can be opened up to other payment types such as micropayments, virtual currencies, rule driven values, consolidated buying, rent and return or barter, but that are safe and secure |

| Service | Supporting the customer throughout the purchasing process with information, assistance and empathy for their situation | Having APIs into the store, order tracking and payments systems would allow information rich applications to be built to improve customer service and build more self-service applications and alerting mechanisms. |

| Fulfillment | Ensuring that the product is fulfilled in the right condition, right time and at the right price, ensuring expectations are correctly set and managed | Opening up the fulfillment systems that would allow new forms of distribution of both electronic and physical goods. |

| Adjustments | Where necessary, the consumer can have their order, price or payment terms adjusted mid-process | Creating new opportunities for gaining purchase revenue and dynamically adjusted pricing – before, during and after the sales transaction. |

| Returns | Where any items for return can be simply returned as part of a hassle-free process | As with fulfillment, open up new physical and technical channels for processing returns via third parties, consolidators and peer-2-peer models. |

Removing the Friction

The existing retailing experience contains a number of points of friction. These points are perceived as negative parts of the customer experience and will cause the consumer not to purchase, to delay purchase, to need additional service resulting in product returns, adjustments or simply additional costs involved in service and recovery. They also generally lower customer lifetime value and word of mouth recommendations.

A major imperative for retailers would be to identify, prioritize and remove the points of friction in the end-to-end experience. A form of win-loss analysis could be employed to understand the leaks in the conversion funnel and the costs of each behavior.

As remedial actions are mandated and implemented, improvements could be instituted that will enable the adoption of new technologies and processes.

Strengths and Weaknesses

The strengths of the traditional retailer lie in their supply chains – the ability to manage suppliers to defined service levels, to design and select products and build assortments and set prices to create a profitable business. Further strengths lay in an ability to manage inventory and move product through the distribution network to stores – providing the ability to create a marketplace of goods in a convenient location.

Therein lies the weakness – the scalability of the entire operation is constrained by the number of suppliers that could be managed, the number of products that formed an in-store assortment and the limitations associated with a logistics network that terminated at the physical store. To reinvent themselves, retailers must work out how to leverage the supply-side competences to lower acquisition, inventory and shipping costs and use those to remain price competitive while they begin to change the customer experience.

Threats and Opportunities

The threats will come from new entrants without legacy physical and technical systems, who are able to reinvent or reengineer traditional business models by slaying sacred cows and overcoming historic constraints. Each innovation will increase choice, convenience or both. The ability to purchase will not come from a single place, rather it will be ubiquitous and purchasing may take on different nuances, as will the notion of ownership.

There is a window of opportunity for traditional retailers to accept that they will need to cannibalize their own businesses before their new competition does so. Acquisitions of companies for their technology and management teams in addition to market entry and local customer bases may be the fastest and lowest risk way of addressing the opportunities.

Competing with Technology Companies

For the past twenty years, retailers have driven competitive advantage through business processes, automated systems and advanced technologies. To continue to do this will require a new level of agility to compete against new entrants without legacy systems, processes and physical assets

An advanced technology infrastructure will comprise:

- The ability to hear, listen and respond to customers needs in real time or near real time

- Seamless multichannel operations that integrate online, physical and virtual assets

- Ability to rapidly partner with, acquire and integrate new channels to market

- Ability to assess, adopt and assimilate new technologies (from systems and user-experience perspectives)

- Ability to join up data (e.g. integrated view of customer, federated view of customer outside the organization, view of the transaction lifecycle)

- A stable and highly scalable platform – that will support systems that are built on top of it

- The agility to roll-out new capabilities across the entire multi-channel model

- A performance management system that makes available a single version of the truth for all decision makers

- To extend operations across international, language and legislative borders

To be a retailer is now to be a technology company. The technology function of the retailer should deliver business advantage to the merchants and should allow them to differentiate the retailing experience and deliver a frictionless experience to the consumer.

Mandate for Change

Rome fell. Since then, other giants have ascended, declined and disappeared. From humble begins, F W Woolworths became a global retailer, yet today only sorry vestiges of that empire remain. Business models that underperform because they are outdated will tire the patience of investors and shareholders. There is an urgency to change, as tomorrow’s retailers will only survive through their agility.

About First Retail

First Retail is a privately funded startup working to leverage semantic web technologies to improve the online commerce experience. First Retail also has a skilled team that is able to undertake Product Management, Product Strategy and Technology Research and Innovation Projects. For further information on how First Retail may be able to help you, please contact info@firstretail.com.

Additional Reading

- Amazon Architecture

- Fashion is the new black online

- In The Giving Mood, Amazon Also Unveils MP3 Gifting (That Can Magically Become Amazon Gift Cards)

- Top Trends of 2010: Social Shopping</a

- Amazon.com’s secret retail empire

- E-Tailer Opens ‘Destination’ Store

- ReplyBuy shows text messaging can make some serious bank with daily deals

- Google Studies How Consumers Shop For Laptops, Netbooks, E-Readers And Tablets

- Report: In-Game Purchases To Blow Mobile Games Revenues Past $11 Billion By 2015

- Virtual goods and prepaid game card sales show steep rise on Black Friday

- Zynga links FarmVille and other games with American Express rewards

- Groupon Shares Its Expansion Plan: Groupon Stores and the Deal Feed

- That Was Quick: eBay Adds Milo Results To Mobile ‘RedLaser’ Apps

- Offermatic’s Love Child Of Mint, Groupon & Blippy Now Open To The Public

- CardPool lets you cash in gift cards for Facebook Credits

- Web-enabled TVs present an e-commerce opportunity

- Google adds new shopping features to Product Search

- Online retail sales may be trouncing physical sales in holiday season

- J.C. Penney Opens Complete Store Within Facebook

- Alice Takes Brands on Different Path