CLV and CBCV for Omnichannel Retail

Chances are you’ve heard the term Customer Lifetime Value (CLV): Google is rolling out an LTV feature; The continued success of Amazon Prime; And the troubles with Lyft’s IPO. The topic of true customer value is now more relevant than ever. The flip side of success is when CLV is not understood, company value can quickly plummet. Private Equity and Hedge funds are beginning to understand Customer-Based Corporate Valuation (CBCV) developed by Theta Equity Partners, and this specific technique has equally penalized Blue Apron and Wayfair. For the retail industry, Customer Centricity is being embraced through revitalized loyalty programs, revved-up omnichannel strategies and re-imagined marketing mix models. CBCV may hold the answer to the success of those programs.

CLV and CBCV

These abbreviations might not mean much to you yet, but they can be incredibly powerful. This is why I want to make the time to properly explain their meaning and possible impact.

What is CLV?

CLV is a prediction of all the value a business will derive from their entire relationship with a customer. It enables us to not only make inferences on the customer base as a whole, but to actually segment it into meaningful cohorts. If you truly think about it ‘understanding your customers’ isn’t even a quantifiable activity. Most opt to understand things like average spend per customer and purchase frequency instead. The irony here is that that the ‘average customer’ does not exist. Peter Fader, who has been at the forefront of “spreading the CLV Gospel” and has already published multiple research papers and two books on the topic, “Not all customers are created equal!”. Which brings us to the real task. Not ‘understanding your customers” but “understanding your BEST customers”.

What is CBCV?

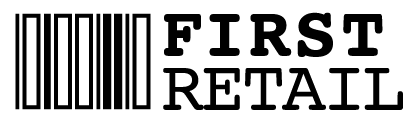

CBCV by definition is explicitly tying the value of a firm’s customer base to its overall financial valuation. This method developed by Peter Fader and Daniel McCarthy takes the ideas from CLV and applies it to an entire company. Rather than thinking of customers as strewn about cohorts related only to individualized campaigns this method allows us an overview of the customer base as a whole without losing the power of “the BEST customers”. You can see a good example for this kind of knowledge in the graph below. It shows the how the value that customers provide to a business is intrinsically heterogeneous.

* RLV stands for Residual Lifetime Value

* RLV stands for Residual Lifetime Value

** Part of Theta Equity Partner’s Express Analysis

Digital Transformation has transformed how we look at customers

It isn’t an accident that these principles are becoming popular at this point in time. In fact it is deeply related to the digital transformation we have undergone in the last two decades. Companies are using the available customer data largely to target them based on their wishes and not on their worth. This is about to change as we can now not only infer “what our customers want” but “what our BEST customers want. Take some time and really think about the true power of this. “Customer Centric Thinking” is what you achieve by knowing what your best customer could do for a business.

Customer is key in Omnichannel Retail

You might be asking yourself “How does this tie to “Omnichannel Retail’ exactly?”. Luckily the answer is fairly straightforward. Customers now have more choices as to how to engage with retailers (online, in-store, social media, etc.) than they have ever had. This means that there is more data on shopping behavior than ever before. In reaction to this trend we now also have more tools than ever to use to analyze, target, and market to these customers. This has led to an oversaturation of methods and tools, all of which only target specific aspects. A lot of you might be asking yourselves “How can I unify all of these approaches?”. CLV is a way to bring us back to reality in terms for how success is measured. Whether you are measuring Open Rates of Loyalty Signups, you are going to want to assign a dollar value to your efforts. That is exactly what CLV will allow you to do. In a world that is starting to become more and more omnichannel it will be increasingly more important to start focusing on the the most valuable customers rather than a plethora of marketing channels.

CLV Impact

Once you’ve stopped thinking of your customer as one mass of average customers and instead a diverse set of cohorts, you will have to decide how to make use of this information. There are a few obvious applications that can make an immediate impact to the unit economics of any business.

Mixed Marketing Modeling

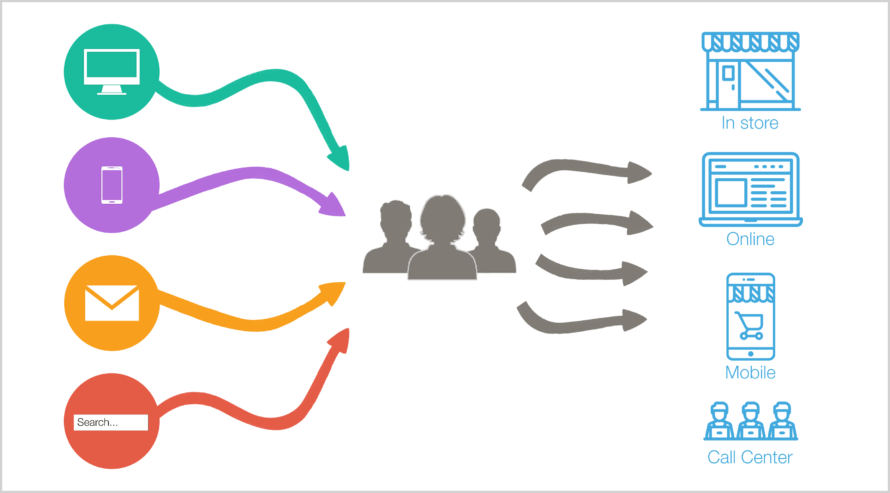

There are numerous applications of CBCV, but for the omnichannel retailer, Marketing Mix Modeling is the one that yields the highest immediate rate of return. This is becoming a more and more important topic as the number of marketing channels seems to be increasing weekly. Most large retailers have a giant ecosystem of marketing tools they are using and want to optimize their spend to maximize the ROI across all of them. MMM can be very effective in measuring the impact of marketing dollars on specific outcomes.

However, there is a big downfall in this approach, namely what is it really that we want to optimize for? Is it Sales, Clicks, Revenue, Impressions, or Customer Acquisition? All of these might give different answers for where to spend your money, which brings us to the foundational issue. With a limited marketing budget, it’s not a question of which channels to focus on, but on which customers. Rather than optimizing for short-term values, such as Sales, the MMM needs to be tuned to generate long-term value by focusing on CLV. This not just an empty promise, but has been tried and established. Bonobos’ for example used insights into which channels are attracting its highest-value shoppers to increase the predicted lifetime value of its new customers by 20%.

* CLV of a channel is defined as the average CLV of all customers whose first purchased was made through this channel

** Part of Theta Equity Partner’s Express Analysis

Highlighting CLV Applications

Other than CBCV, which is analyzes at a corporate level, there are a lot of applications for individual level CLV as well. Businesses have used this kind of information to inform a variety of decisions.

- Loyalty: U.S. Auto parts increased its spend per member by 20%, its repurchase rate by 14%, and its enrollment rate by 45% after implementing increased rewards for high-margin products, a status tier, and many other investments into their existing customers

- Store Policy: Zappos learned that people who regularly return items can be some of your best customers. The highest spenders and most profitable customers also have a 50% return rate. So Zappos has a 365-day returns policy, free two-way shipping and doesn’t charge for returns.

- Customer Service: Hear and Play Music used this information for their Customer Service System. They now send out automated messages that have a personalized tone to high value prospect. This has lead the company to see a 416% increase in CLV.

- Product Development: EA has used it as parts of their Product Development Strategy for game like Anthem, Apex Legends and Battlefield V. This has been a large part of the incredible success these games. Anthem for example was the highest selling game in February, and while the sales for Battlefield V have tempered down by now it was a world-wide success after its release.

These examples are by no means the end of the line. Understanding where to spend time and resources to deliver most value to shoppers and company can have many more forms. This could be used to adjust your strategy for assortment, products and services, merchandising, operations, etc. And these are just the use cases that we thought of.

Start with the Customer

CLV made its way into Silicon Valley, Wall Street and even the Gaming Industry. With the digital transformation becoming an established reality it seems to be here to stay. As a byproduct of this customer data is the commodity of the future. How you use that commodity will depend on your understanding of your CLV. The range of applications is endless, and if you haven’t’ started thinking about how it yet, you might want to start today.

If that has convinced you to start looking into your companies CLV metrics, you might be wondering where to begin. The best place to start with this journey is to define a Data Strategy that is aimed to truly understand your best customers. Interestingly enough the best place to start a Data Strategy is also to define how to value your best customers. This includes identifying what you know and / or don’t know about them. This means exploring what kind of mechanisms and methods your company currently uses to keep track of that data. But it also means looking outward. Ask yourself what tactics do you need to undertake to better reach/serve your customers? Once you start grasping how data moves in and out of your company and how it affects your customers you are on the right track. If this still feels a bit daunting to you just contact us here. First Retail is now working with Peter Fader’s team to help retailers use CBCV to measure the overall effectiveness of changes to their Marketing Mix Modeling strategies and to understand the valuation effect of the introduction of (or changes to) loyalty programs.